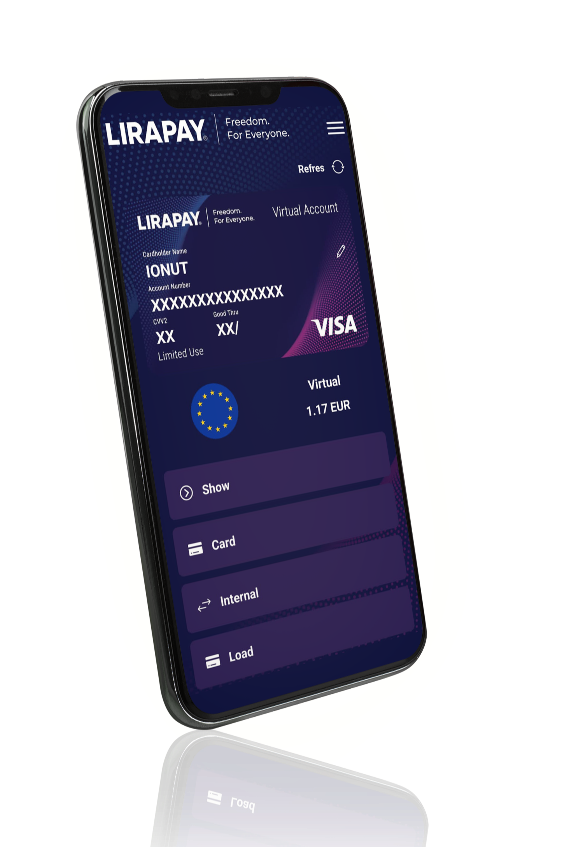

Lirapay is more than just an app - it's a complete financial solution that offers all the benefits of a debit VISA card controlled through our intuitive mobile platform. With our VISA license, you can enjoy the peace of mind, security, and flexibility that come with using an instrument backed by one of the world's largest and most respected financial organizations. Whether you prefer a physical or virtual card, Lirapay has you covered. Our vision is to continue our tradition of excellence by providing the finest financial services possible. At Lirapay, we understand that an honest human connection is the foundation of everything we do, and we are committed to earning your trust by offering effective and transparent financial services. We believe that the only way to truly deliver value to our customers is by operating at the highest fiduciary and ethical levels. That's why we strive to set new standards for the financial market and exceed our customer's expectations every step of the way. Join us today and experience the Lirapay difference for yourself.

Know Your Customer are guidelines and regulations in financial services that require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer.

It is a crucial part of regulatory compliance and serves several important purposes. Here are some reasons why we require our customers to undergo KYC:

1. Regulatory Compliance: LIRAPAY is a financial institution and is subject to stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations imposed by government authorities. KYC procedures help banks comply with these regulations and prevent illicit activities, such as money laundering, fraud, and terrorist financing.

2. Identity Verification: KYC helps verify the identity of our customers. By collecting and verifying personal information, such as name, address, date of birth, and identification documents (e.g., ID Card, Passport, Driver's License), LIRAPAY can establish the true identity of individuals and reduce the risk of identity theft and impersonation.

3. Risk Assessment: KYC processes enables our company to assess the risk associated with each customer. By gathering information about the customer's financial status, occupation, source of funds, and intended transactions, we can evaluate the potential risk of money laundering or other illegal activities. This allows us to identify and mitigate potential risks proactively.

4. Fraud Prevention: KYC helps to detect and prevent fraudulent activities. By verifying customer identities and conducting due diligence, LIRAPAY can identify red flags and suspicious patterns that may indicate fraudulent behavior. This helps protect both the company and its customers from financial losses and reputational damage.

5. Enhanced Security: KYC procedures contribute to the overall security of the banking and financial system. By ensuring that customers are who they claim to be, LIRAPAY can minimize the risk of unauthorized account access, fraudulent transactions, and identity theft. This helps maintain the integrity of the financial system and promotes customer confidence.

6. Legal Obligations: By working with the Banking and Financial System, our company has legal obligations to implement robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures. Non-compliance with these obligations can result in severe penalties, legal consequences, and damage to the company's reputation. KYC helps us fulfill the legal requirements and demonstrate the commitment to regulatory compliance.

Answer. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur id suscipit ex. Suspendisse rhoncus laoreet purus quis elementum. Phasellus sed efficitur dolor, et ultricies sapien. Quisque fringilla sit amet dolor commodo efficitur. Aliquam et sem odio. In ullamcorper nisi nunc, et molestie ipsum iaculis sit amet.

As a financial institution, we need to know who you are. We are required by law to verify your identity before giving you access to LIRAPAY’s financial services. Our application and processes are created in full compliance with banking laws.

Identity verification is started after you identify yourself through the app. During this process, you will need to check your email for confirmation or requests for additional information and guidance from our team.

We may ask for documents containing your address: If your ID does not have an address. Proof of address could be a copy of your bank statement or utility bill (all utility bills issued within the last 3 months are accepted, except mobile phone bills).

We may ask for a residence permit:

If your country of origin is outside the European Economic Area.

We may ask you for an alternative ID in some of the following cases:

The ID you showed us is worn and the information on it cannot be read:

Our agents noticed discrepancies;

The identity document expires in less than 3 months - If the identity document has expired, you will need to upload a valid one in the LIRAPAY application;

The identity document is not a biometric document.

Yes. You can open up to 5 Virtual Accounts or 2 Plastic Cards in each of the 4 currencies offered by LIRAPAY. Currently available currencies are: EUR, USD, GBP and RON. We will add more currencies soon.

You can also see all the fees and commissions by accessing the link

Subscribe to our newsletter for the latest finance news.

Pentru moment aceasta optiune nu este disponiliba. Compleateaza adresa ta de email mai jos, pentru a fi printre primii care afla cand acest serviciu devine disponibil: